Money. We all have (at least some of) it, we all want (at least a little) more of it. And one of my personal goals this year is to get better at managing it, along with making the aforementioned more of it. Along the way, I’ve come across some amazing apps that help me out…all listed below! I’d love to hear your contributions too, so chime in in the comments, on the Facebook page, or on Twitter (tweet @_chelleshock). Without further ado…

Harvest

If you’re a long time reader, you know I love Harvest. I just can’t gush enough about it: their customer support is personable and fast, their social media people are fun and have a sense of humor, the interface is great, and it’s so easy to find my important data. I use Harvest to invoice, get paid through Paypal or Stripe, see past transactions and incoming payments, track my time, and do client audits. I’ve been using it for something like three years now. It’s my favorite.

Digit

I talked about Digit in my last favorite things post, but I’m going to rave about it some more. Whether you use the account it creates as a personal account or a business account, the end result is the same: it makes saving easier. And where savings are important for anyone to have, they’re extra important for us freelancers, who can have unexpected business expenses (or unexpected cash droughts). Digit makes saving painless and its daily text check ins keep me aware of my current money situation, too.

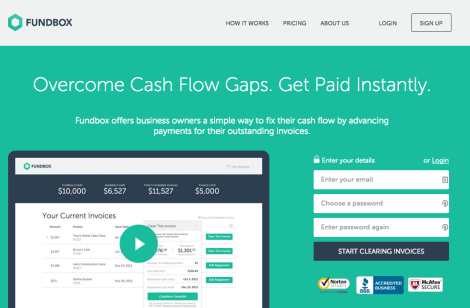

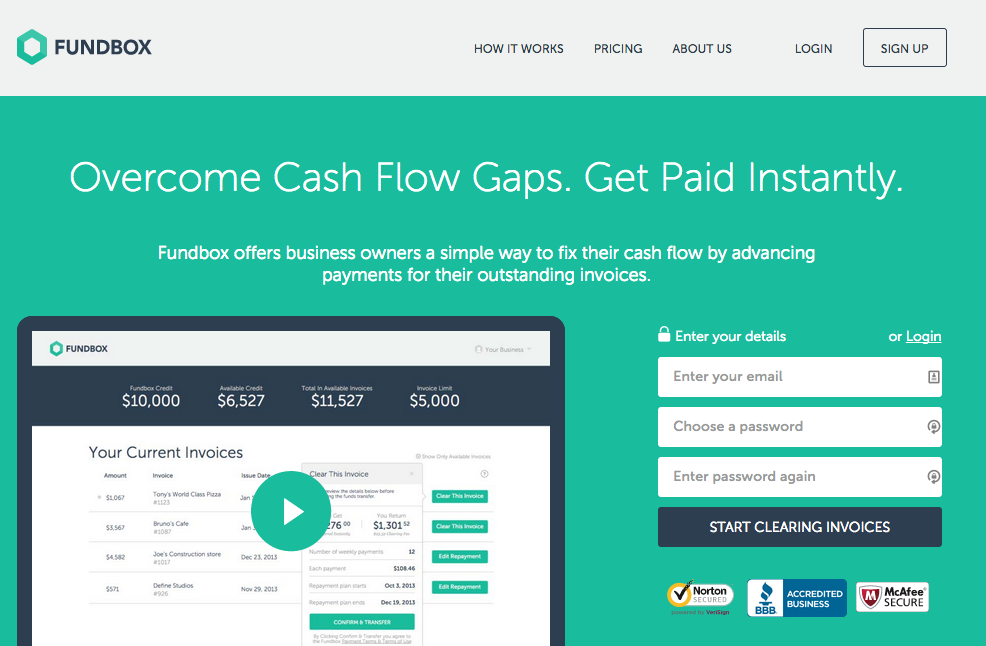

Fundbox

We all have that one client that is a little off with their payment schedule. Sometimes they pay in less than 24 hours. Sometimes…not so much. For those awkward situations or any other payment gap you’ve got, Fundbox gets you paid, faster. The idea is simple: you hook it up to your invoicing/accounting tool of choice (in my case, Harvest), and it tells you how many invoices you can clear. You select an invoice and get the money for it in the next 24-48 hours, directly in your bank account. Then you pay Fundbox back over 12 weeks or so, or quicker if you want (no penalties for paying back early).

Obviously, you don’t want to use this for all your invoices–the fees would cut into your profit margins. But if you’re in an “I need money right now” situation for whatever reason, or just want to even out your cashflow a bit for the time being, it’s a good backup to have.

Up-and-comer: Cheddar

Ugh, I want Cheddar now and it’s still in beta/development. *angry foot stomping* As a freelancer, I have several bank/financial accounts to balance–business, business savings, personal checking, personal savings, Paypal…and the idea of being able to look at it all in one spot, with a good UI, transfer between accounts without using gawdawful mobile apps (here’s looking at you, Wells Fargo), and get reports on spending/saving/net worth…yeah. I want this.

The main hole: accurate bookkeeping/expense tracking

This is my shortfall right now. Currently, I’m scanning things with Scannable into an Accounting notebook in Evernote, so that I have receipts on file, and keep track of expenses/income in a Google Docs folder. I have Xero set up, and have it set to sync with Harvest, but am slightly (possibly unreasonably) intimidated by it, and know that I’m not using it to the fullest of its capabilities. I’ve heard good things about Expensify, but it seems to be mostly intended for teams/employees. The praise I heard about it was from a fellow solopreneur, though, so I may give it a go regardless.

Also, I’m still finding that perfect budgeting app. Everything is either way too automated (and automates badly/inaccurately) or way too manual. Or ugly. Sometimes being a design snob makes things difficult. So, I’m totally looking for suggestions there. Or your suggestions in general–what do you use that’s a total lifesaver? Anything changed your money game? I want to hear it!

(Disclaimer: Most of these links are referral links, which means if you click through and become a user, I save money on my own account. I promise they’re all things I actually use/want to use and that the promise of a $10 credit isn’t making me go mad with power and link out willy-nilly to shitty products.)